Contents:

This type of order converts into a market order when the security price reaches the stop price. Deciding how to determine the exit points of your positions depends on how conservative you are as a trader. Shrewd traders always maintain the option of closing out a position at any time by submitting a sell order at the market. A stop-loss order is a tool used by traders and investors to limit losses and reduce risk exposure. By using a stop-loss order, a trader limits his risk in the trade to a set amount in the event that the market moves against him. A Trailing stop loss order creates a market order when the trailing stop loss level is reached.

It can be done manually by regularly dragging the stop loss order to the level of a chosen moving average indicator. But there are scripts that automatically trail the price based on the chosen moving average. Trailing stops are used to protect profits, so they are also known as protective stops. I’m a newbie and with my paper trades I’ve just been setting up regular stop losses.

Scenario 1: Price goes down

All you need to do is to https://forexarena.net/ your chosen percentage, say 10%. But if the trader was using a trailing stop, say trailing at $3 away from the current price, the trailing stop would have been at $81.3 when the price reversed. So he would have locked-in $6.3 profit, rather than ending up with a loss. When you use this type of trailing stop, the stop loss starts trailing as soon as the trade moves in a positive direction. So each individual market and even each currency pair or stock might need to use a different retracement setting. The final method that I want to share with you in this tutorial is to exit a trade after price has retraced by a certain percentage of the high or low of the move.

- The average true range is a very important indicator that is used to measures volatility in the market.

- Another complaint about trailing stop loss order is that they don’t protect you from the major market moves which are greater than your stop position.

- The stop-loss order then turns into a limit order when the stock hits your stop.

- As each new candle closes, the 3rd candle also moves forward and you move your stop loss accordingly.

- A stop-loss order exits you out of your position if your stock hits your set stop price.

If the price were to fall to $19.70, the stop loss would fall to $19.80. If the price were to rise to $19.80 or higher, your order will be converted to a market order, and you would exit the trade with a gain of about 20 cents per share. This type of order is meant to lock in profits while protecting you from significant losses. A trailing stop loss can also be placed on short equity positions and options. Stop orders are executed based upon actual transactions, rather than the bid and offer price. Once the stop is triggered with a transaction, the stop becomes a market order.

Now, when your favorite moving average is holding steady at this angle, stay with your initial trailing stop loss. As the moving average changes direction, dropping below 2 p.m., it’s time to tighten your trailing stop spread . When the price increases, it drags the trailing stop along with it.

On the other hand, a trailing stop limit order will send a limit order once the stop price is reached, meaning that the order will be filled only on the current limit level or better. Trailing stop limit orders offer traders more control over their trades but can be risky if the price falls fast. Traders who trade mean reversion strategies usually don’t implement trailing stop losses. The main reason for this is that a mean reversion edge gets better the more a security has gone down. Therefore, it is hard to place a trailing stop that will lock in profits, since it will become so wide that it fails to serve that purpose.

Trailing Stop Loss vs. Trailing Stop Limit

It does not tell you how much of your account you have risked on the trade, though. As a day trader, you should always use a stop-loss order on your trades. Barring slippage, the stop-loss lets you know how much you stand to lose on a given trade. Asktraders is a free website that is supported by our advertising partners. As such we may earn a commision when you make a purchase after following a link from our website.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Patterns are just one variable to consider before entering a trade. A lot of them lose because they don’t think they need an education.

As noted, a trailing stop loss can be created in one of two ways. You can either use a fixed price or a relative one based on a percentage. With a trailing stop loss order, say you have a $15 stock. You might establish a trailing stop loss order of 10% instead of a traditional stop loss order at, say, $13.50.

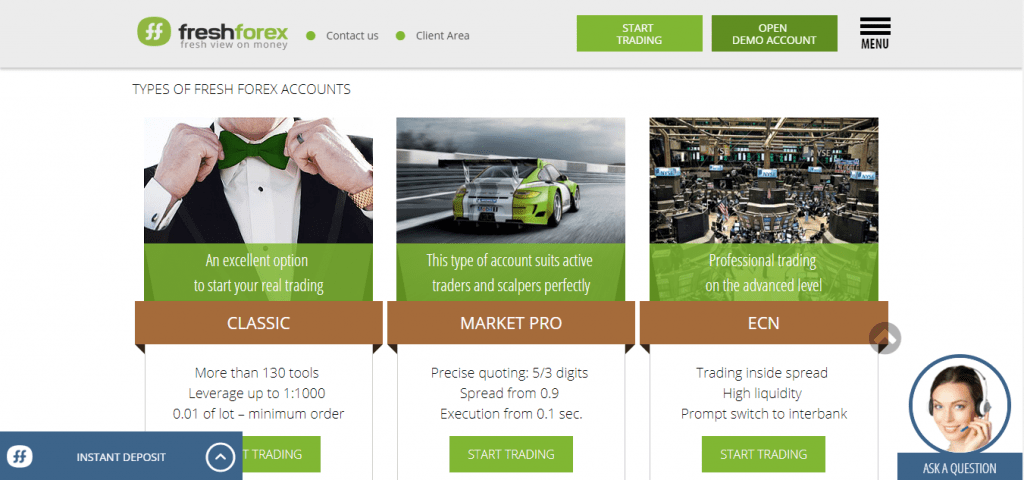

Built-in Trailing Stop on Trading Platforms

The trailing amount, designated in either points or percentages, then follows (or “trails”) a stock’s price as it moves up or down . Many traders calculate their initial position size based on their risk. That’s because you determine how much below the top price you’ll allow it to drop. This is either a set percentage or amount below the top price.

Hawks fall to Wizards in Snyder’s debut – Peachtree Hoops

Hawks fall to Wizards in Snyder’s debut.

Posted: Wed, 01 Mar 2023 13:41:02 GMT [source]

Familiarize yourself with the risks and explore how trailing stop orders can help support your exit strategy. If you’re not already using trailing stop loss, you should start. It will give your account a lot more protection and stability in the event of an unexpected financial downturn or during volatile market conditions. You can also use it to lock in profits when your trade is doing well and increase the percentage of profit if possible without risking too much capital on each trade. You can also choose where to set these orders – at the current price or at the average of recent prices. Trailing stop losses allow traders to set a trailing value at which they want their position to close if the price moves against them too quickly.

Using Trailing Stop Loss For Short Positions

The order will only get https://trading-market.org/ when the trend moves against you. You can also use the moving average indicator as a trailing stop, given that it tracks the price of an asset very smoothly. The MA works in much the same way as the ATR indicator, but you cannot have multiple MA, as is the case with the ATR.

- In other words, the exit order can be triggered without obvious reasons for that.

- You determine the limit price by specifying how far from the trigger price you’ll allow the sale of your stock to take place.

- This can be tough for some traders to handle on a psychological level.

- Can help protect potential profits while providing downside protection.

- The trailing stop loss freezes below the highest price the asset reached.

What’s more, it may happen when the asset price is lightly dropping but not actually pulling back hard or reversing. In other words, the exit order can be triggered without obvious reasons for that. So, make sure to place the stop level on a distance that the price is not supposed to reach. However, it will depend on the type of trade you are getting in. For instance, if you sell an asset that you have during a long trade, the stop price should be set below the level of the entry point.

But as soon as price starts consolidating or retracing, you are stopped out and you take your profits off the table. You have to be patient and let the support levels develop, or you can move your stop loss too early and get stopped out prematurely. Support and resistance levels can be great ways to trail your stop.

If the https://forexaggregator.com/ goes up to $10.97, the stop value will change and climb to $10.77. In case the asset price falls back to $10.90, the stop value will remain at the same level. But if it keeps on going down and reaches $10.76, your stop level will change while the market order will be triggered instantly. Trailing stop orders can also be used to determine when to execute a buy order or a sell order. Based on the two scenarios discussed, we can set a trailing stop sell order when trading in an open long position.

With a limit order, you’ll sell all or part of your position at your limit price or better, or you won’t sell at all. This protects you from selling into a market that is falling quickly, where your executed price could be much lower than your trigger price. However, the downside is that you may not sell at all, or only sell part of your position, and the price of the stock could move even lower. For example, in Scenario 1, if the price suddenly drops lower than $75.00 before your sell order can be filled, there will be no sale at your limit price.

You need to set a stop point for a trade, even if it’s only written on your trading plan. This is great for both swing traders and part-time traders. It allows you to ride a stock as it uptrends and exit when the uptrend reverses a certain percentage. A major key to limiting your trading losses is planning your trades.